The 10-Minute Rule for Ach Processing

For many years, the globe of financial has actually customized radically and also has actually internationally impacted numerous people. Throughout this age of growth, rather than paying by cash, checks, debt or debit card, the payment process has evolved right into faster, more secure and also extra efficient digital techniques of moving money. Automated Clearing Up House (ACH) has actually made this feasible.

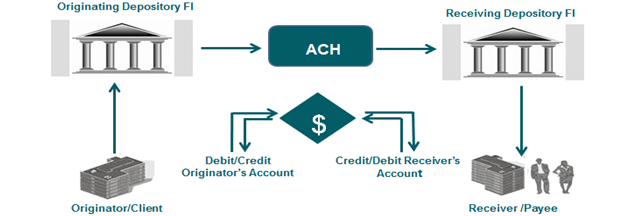

There are 2 main classifications for which both customers as well as organizations utilize an ACH transfer. Direct payments (ACH debit transactions) Straight deposits (ACH credit purchases) Some financial organizations also provide expense repayment, which permits customers to arrange as well as pay all bills digitally utilizing ACH transfers. Or you can use the network to initiate ACH purchases in between people or vendors abroad.

An ACH payment is made using the ACH network, instead than going through the major card networks like Visa or Mastercard.

Ach Processing Can Be Fun For Anyone

An ACH debit deal does not entail physical paper checks or debit card. ach processing. The only information the payee requires is a bank account and routing number. To start a purchase with ACH, you'll require to license your biller, such as your electrical company, to pull funds from your account. This typically occurs after you provide your checking account and also directing numbers for your bank account as well as provide your consent by either physically or online authorizing an agreement with your biller.

You can also set up a web link in between your biller and also your financial institution account without accrediting automated settlements. This provides you higher control of your account, enabling you to transmit repayment funds only when you particularly allow it.

It moves news cash from the company's financial institution account to a staff member's in a simple and reasonably economical way. The company just asks their financial institution (or pay-roll company) to instruct the ACH network to draw cash from their account and down payment it as necessary. Furthermore, ACH deposits allow people to start deposits elsewherebe that a costs repayment or a peer-to-peer transfer to a buddy or property owner.

Excitement About Ach Processing

An ACH direct payment provides funds right into a financial institution account as have a peek at this site credit report. When you obtain repayments via straight down payment with ACH, the benefits include ease, less fees, no paper checks, and quicker tax obligation reimbursements.

Photo resource: The Equilibrium The number of debit or ACH debts refined yearly is steadily enhancing. In 2020, the ACH network processed monetary transactions worth greater than $61. 9 trillion, a boost of virtually 11 percent from the previous year. These consisted of government, consumer, as well as business-to-business deals, as well as international settlements.

The 5. 3 billion B2B paymentsvalued at $50 trillionreflect a 20. 4% increase from 2020, as the pandemic fast-tracked organizations' switch to ACH settlements. Over simply the past 2 years, ACH B2B payments are up 33. 2%. An ACH debt includes ACH transfers where funds are pushed into a checking account.

For instance, when someone establishes a repayments via their bank or cooperative credit union to pay bills from their nominated checking account, these settlements would be processed as ACH credit reports. ACH debit purchases involve ACH transfers where funds are pulled from a checking account. That is, the payer, or consumer offers the payee approval to full repayments from their chosen savings account whenever it becomes due.

The Ach Processing Diaries

ACH and charge card payments both permit you to take repeating payments merely and conveniently. However, there are 3 major distinctions that it may be useful to highlight: the guarantee of payment, automated clearing home handling times, and also charges. When it pertains to ACH vs. bank card, the most important distinction is the guarantee of repayment.

:max_bytes(150000):strip_icc()/how-ach-payments-work-315441-v2-5b4cb9f346e0fb005bd7eeae.png)

Comments on “Not known Facts About Ach Processing”